In a previous blog post we used the

'Polyhedral Inference' trick of Lee et al. to perform

conditional inference on the asset with maximum Sharpe ratio.

This is now a short paper on arxiv.

I was somewhat disappointed to find, as noted in the paper,

that polyhedral inference has lower power than a simple Bonferroni correction

against alternatives where many assets have the same Signal-Noise ratio.

(Though apparently it has higher power when one asset alone higher SNR.)

The interpretation is that when there is no spread in the SNR, Bonferroni

correction should have the same power as a single asset test, while

conditional inference is sensitive to the conditioning information that

you are testing a single asset which has Sharpe ratio perhaps near that of

other assets. In the opposite case, Bonferroni suffers from having to 'pay'

for a lot of irrelevant (for having low Sharpe) assets, while conditional

inference does fine.

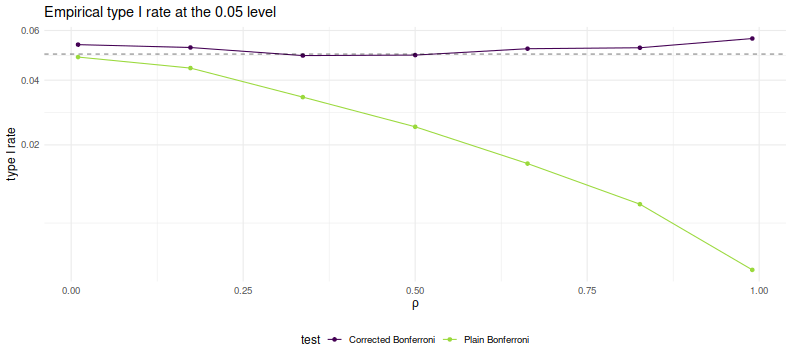

I also showed in the paper, as I demonstrated in a previous blog post,

that the Bonferroni correction is conservative when asset

returns are correlated. In a simple simulations under the null, I showed

that the empirical type I rate goes to zero as common correlation $\rho$ goes to one.

In this blog post I will describe a simple trick to correct for average positive

correlation.

So let us suppose that we observe returns on $p$ assets over $n$ days,

and that returns have correlation matrix $R$.

Let $\hat{\zeta}$ be the vector of Sharpe ratios over this sample.

In the paper I show that if returns are normal then the following

approximation holds

$$

\hat{\zeta}\approx\mathcal{N}\left(\zeta,\frac{1}{n}\left(

R + \frac{1}{2}\operatorname{Diag}\left(\zeta\right)\left(R \odot R\right)\operatorname{Diag}\left(\zeta\right)

\right)\right).

$$

There is a more general form for Elliptically distributed returns.

In the paper I find, via simulations, that for realistic

SNRs and large sample sizes, the more general form does not add much

accuracy. In fact, for the small SNRs one is likely to see in practice

the simple approximation

$$

\hat{\zeta}\approx\mathcal{N}\left(\zeta,\frac{1}{n}R\right)

$$

will suffice.

Now note that, under the null hypothesis that $\zeta = \zeta_0$, one has

$$

z = \sqrt{n} \left(R^{1/2}\right)^{-1} \left(\hat{\zeta} - \zeta_0\right) \approx\mathcal{N}\left(0,I\right),

$$

where $R^{1/2}$ is a matrix square root of $R$.

Testing the null hypothesis should proceed by computing (or estimating) the

vector $z$, then comparing to normality, either by a Chi-square statistic,

or performing Bonferroni-corrected normal inference on the largest element.

In the paper I used a simple rank-one model for correlation for simulations

using

$$

R = \left(1-\rho\right) I + \rho 1 1^{\top}.

$$

This effectively models the influence of a common single 'latent' factor.

Certainly this is more flexible for modeling real returns

than assuming identity correlation, but is not terribly realistic.

Under this model of $R$ it is simple enough to compute the inverse-square-root

of $R$. Namely

$$

\left(R^{1/2}\right)^{-1} = \left(1-\rho\right)^{-1/2} I + \frac{1}{p}\left(\frac{1}{\sqrt{1-\rho+p\rho}} - \frac{1}{\sqrt{1-\rho}}\right)1 1^{\top}.

$$

Let's just confirm with code:

p <- 4

rho <- 0.3

R <- (1-rho) * diag(p) + rho

ihR <- (1/sqrt(1-rho)) * diag(p) + (1/p) * ((1/sqrt(1-rho+p*rho)) - (1/sqrt(1-rho)))

hR <- solve(ihR)

R - hR %*% hR

[,1] [,2] [,3] [,4]

[1,] 4.44089e-16 1.66533e-16 1.11022e-16 1.66533e-16

[2,] 1.66533e-16 0.00000e+00 5.55112e-17 5.55112e-17

[3,] 1.66533e-16 1.66533e-16 0.00000e+00 1.11022e-16

[4,] 1.11022e-16 1.11022e-16 1.11022e-16 2.22045e-16

So to test the null hypothesis, one computes

$$

z = \sqrt{n} \left( \left(1-\rho\right)^{-1/2} I + \frac{1}{p}\left(\frac{1}{\sqrt{1-\rho+p\rho}} - \frac{1}{\sqrt{1-\rho}}\right)1 1^{\top} \right)

\left(\hat{\zeta} - \zeta_0\right)

$$

to test against normality. But note that our linear transformation is monotonic (indeed affine):

if $v_i \ge v_j$ and $w = \left(R^{1/2}\right)^{-1} v$, then $w_i \ge w_j$.

This means that the maximum element of $z$ has the same index as the maximum element of

$\hat{\zeta} - \zeta_0$.

To perform Bonferroni correction we need only transform the largest element of

$\hat{\zeta} - \zeta_0$, by scaling it up, and shifting to accomodate the average.

So if the largest element of $\hat{\zeta} - \zeta_0$ is $y$, and the average value

is $a = \frac{1}{p}1^{\top} \left(\hat{\zeta} - \zeta_0\right)$, then the largest

value of $z$ is

$$

\frac{\sqrt{n} y}{\sqrt{1-\rho}} + a \sqrt{n} \left(\frac{1}{\sqrt{1-\rho+p\rho}} - \frac{1}{\sqrt{1-\rho}}\right)

$$

Reject the null hypothesis if this is larger than $\Phi\left(1 - \alpha/p\right)$.

Simulations

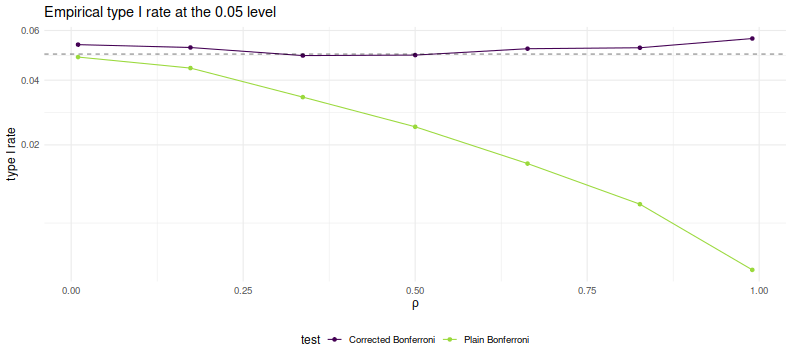

Here we perform simple simulations of Bonferroni and corrected Bonferroni.

We will assume that returns are Gaussian, that the correlation follows

our simple rank one form, that the correlation is known in order to perform the

corrected test.

We simulate two years of daily data on 100 assets. For each choice of $\rho$

we perform 10000 simulations under the null of zero SNR, computing the simple and 'improved'

Bonferroni corrected hypothesis tests. We tabulate the empirical type I rate

and plot against $\rho$.

suppressMessages({

library(dplyr)

library(tidyr)

library(future.apply)

})

# set up the functions

rawsim <- function(nday,nlatf,nsim=100,rho=0) {

R <- pmin(diag(nlatf) + rho,1)

mu <- rep(0,nlatf)

apart <- sqrt(nday)/sqrt(1-rho)

bpart <- sqrt(nday) * ((1/sqrt(1-rho+nlatf*rho)) - (1/sqrt(1-rho)))

mhtpvals <- replicate(nsim,{

X <- mvtnorm::rmvnorm(nday,mean=mu,sigma=R)

x <- colMeans(X) / apply(X,2,sd)

bonf_pval <- nlatf * SharpeR::psr(max(x),df=nday-1,zeta=0,ope=1,lower.tail=FALSE)

# do the correction

corr_stat <- apart * max(x) + bpart * mean(x)

corr_pval <- nlatf * pnorm(corr_stat,lower.tail=FALSE)

c(bonf_pval,corr_pval)

})

data_frame(bonf_pvals=as.numeric(mhtpvals[1,]),

corr_pvals=as.numeric(mhtpvals[2,]))

}

many_rawsim <- function(nday,nlatf,rho,nsim=1000L,nnodes=7) {

if ((nsim > 10*nnodes) && require(future.apply)) {

plan(multisession, workers = 7)

nper <- as.numeric(table(1:nsim %% nnodes))

retv <- future_lapply(nper,function(aper) rawsim(nday=nday,nlatf=nlatf,rho=rho,nsim=aper)) %>%

bind_rows()

plan(sequential)

} else {

retv <- rawsim(nday=nday,nlatf=nlatf,rho=rho,nsim=nsim)

}

retv

}

mhtsim <- function(alpha=0.05,...) {

many_rawsim(...) %>%

tidyr::gather(key=method,value=pvalues) %>%

group_by(method) %>%

summarize(rej_rate=mean(pvalues < alpha)) %>%

ungroup() %>%

arrange(method)

}

# perform simulations

nsim <- 10000

nday <- 2*252

nlatf <- 100

params <- data_frame(rho=seq(0.01,0.99,length.out=7))

set.seed(123)

resu <- params %>%

group_by(rho) %>%

summarize(resu=list(mhtsim(nday=nday,nlatf=nlatf,rho=rho,nsim=nsim))) %>%

ungroup() %>%

unnest()

suppressMessages({

library(dplyr)

library(ggplot2)

})

# plot empirical rates:

ph <- resu %>%

mutate(method=gsub('bonf_pvals','Plain Bonferroni',method)) %>%

mutate(method=gsub('corr_pvals','Corrected Bonferroni',method)) %>%

ggplot(aes(rho,rej_rate,color=method)) +

geom_line() + geom_point() +

geom_hline(yintercept=0.05,linetype=2,alpha=0.5) +

scale_y_sqrt() +

labs(title='Empirical type I rate at the 0.05 level',

x=expression(rho),y='type I rate',

color='test')

print(ph)

As desired, we maintain nominal coverage using the correction for $\rho$, while

the naive Bonferroni is too conservative for large $\rho$.

This is not yet a practical test, but could be used for rough estimation by

plugging in the average sample correlation (or just SWAG'ing one).

To my tastes a more interesting question is whether one can

generalize this process to a rank $k$ approximation of $R$ while

keeping the monotonicity property. (I have my doubts this is possible)

Click to read and post comments

In a previous blog post we looked at a symmetric

confidence intervals on the Signal-Noise ratio.

That study was motivated by the "opportunistic strategy", wherein

one observes the historical returns of an asset to determine whether

to hold it long or short. Then, conditional on the sign of the trade,

we were able to construct proper confidence intervals on the Signal-Noise

ratio of the opportunistic strategy's returns.

I had hoped that one could generalize from the single asset opportunistic

strategy to the case of $p$ assets, where one constructs the Markowitz

portfolio based on observed returns.

I have not had much luck finding that generalization.

However, we can generalize the opportunistic strategy in a different

way to what I call the "Winner Take All" strategy.

Here one observes the historical returns of $p$ different assets,

then chooses the one with the highest observed Sharpe ratio to hold long.

(Let us hold off on an Opportunistic Winner Take All.)

Observe, however, this is just the problem of inferring the Signal Noise

ratio (SNR) of the asset with the maximal Sharpe.

We previously approached that problem using a

Markowitz approximation, finding it somewhat lacking.

That Markowitz approximation was an attempt to correct some deficiencies

with what is apparently the state of the art in the field, Marcos

Lopez de Prado's (now AQR's?) "Most Important Plot in All of Finance",

which is a thin layer of Multiple Hypothesis Testing correction over the

usual distribution of the Sharpe ratio.

In a previous blog post, we found that

Lopez de Prado's method would have lower than nominal type I rates

as it ignored correlation of assets.

Moreover, a simple MHT correction will not, I think,

deal very well with the case where there are great differences

in the Signal Noise ratios of the assets.

The 'stinker' assets with low SNR will simply spoil our inference,

unlikely to have much influence on which asset shows the

highest Sharpe ratio, and only causing us to increase our

significance threshold.

With my superior googling skills I recently discovered a 2013 paper

by Lee et al,

titled Exact Post-Selection Inference, with Application to the Lasso.

While aimed at the Lasso, this paper includes a procedure that

essentially solves our problem, giving hypothesis tests or

confidence intervals with nominal coverage on the asset with

maximal Sharpe among a set of possibly correlated assets.

The Lee et al paper assumes one observes $p$-vector

$$

y \sim \mathcal{N}\left(\mu,\Sigma\right).

$$

Then conditional on $y$ falling in some polyhedron, $Ay \le b$, we wish

to perform inference on $\nu^{\top}y$.

In our case the polyhedron will be the union of all polyhedra with the same

maximal element of $y$ as we observed.

That is, assume that we have reordered the elements of $y$ such that $y_1$ is the

largest element. Then $A$ will be a column of negative ones, cbinded to the $p-1$ identity

matrix, and $b$ will be a $p-1$ vector of zeros.

The test is defined on $\nu=e_1$ the vector with a single one in the first element

and zero otherwise.

Their method works by decomposing the condition $Ay \le b$ into a condition on

$\nu^{\top}y$ and a condition on some $z$ which is normal but independent of

$\nu^{\top}y$.

You can think of this as kind of inverting the transform by $A$.

After this transform, the value of $\nu^{\top}y$ is restricted to a line

segment, so we need only perform inference on a truncated normal.

The code to implement this is fairly straightforward, and given below.

The procedure to compute the quantile function, which we will need

to compute confidence intervals, is a bit trickier, due to numerical

issues. We give a hacky version below.

# Lee et. al eqn (5.8)

F_fnc <- function(x,a,b,mu=0,sigmasq=1) {

sigma <- sqrt(sigmasq)

phis <- pnorm((c(x,a,b)-mu)/sigma)

(phis[1] - phis[2]) / (phis[3] - phis[2])

}

# Lee eqns (5.4), (5.5), (5.6)

Vfuncs <- function(z,A,b,ccc) {

Az <- A %*% z

Ac <- A %*% ccc

bres <- b - Az

brat <- bres

brat[Ac!=0] <- brat[Ac!=0] / Ac[Ac!=0]

Vminus <- max(brat[Ac < 0])

Vplus <- min(brat[Ac > 0])

Vzero <- min(bres[Ac == 0])

list(Vminus=Vminus,Vplus=Vplus,Vzero=Vzero)

}

# Lee et. al eqn (5.9)

ptn <- function(y,A,b,nu,mu,Sigma,numu=as.numeric(t(nu) %*% mu)) {

Signu <- Sigma %*% nu

nuSnu <- as.numeric(t(nu) %*% Signu)

ccc <- Signu / nuSnu # eqn (5.3)

nuy <- as.numeric(t(nu) %*% y)

zzz <- y - ccc * nuy # eqn (5.2)

Vfs <- Vfuncs(zzz,A,b,ccc)

F_fnc(x=nuy,a=Vfs$Vminus,b=Vfs$Vplus,mu=numu,sigmasq=nuSnu)

}

# invert the ptn function to find nu'mu at a given pval.

citn <- function(p,y,A,b,nu,Sigma) {

Signu <- Sigma %*% nu

nuSnu <- as.numeric(t(nu) %*% Signu)

ccc <- Signu / nuSnu # eqn (5.3)

nuy <- as.numeric(t(nu) %*% y)

zzz <- y - ccc * nuy # eqn (5.2)

Vfs <- Vfuncs(zzz,A,b,ccc)

# you want this, but there are numerical issues:

#f <- function(numu) { F_fnc(x=nuy,a=Vfs$Vminus,b=Vfs$Vplus,mu=numu,sigmasq=nuSnu) - p }

sigma <- sqrt(nuSnu)

f <- function(numu) {

phis <- pnorm((c(nuy,Vfs$Vminus,Vfs$Vplus)-numu)/sigma)

#(phis[1] - phis[2]) - p * (phis[3] - phis[2])

phis[1] - (1-p) * phis[2] - p * phis[3]

}

# this fails sometimes, so find a better interval

intvl <- c(-1,1) # a hack.

# this is very unfortunate

trypnts <- seq(from=min(y),to=max(y),length.out=31)

ys <- sapply(trypnts,f)

dsy <- diff(sign(ys))

if (any(dsy < 0)) {

widx <- which(dsy < 0)

intvl <- trypnts[widx + c(0,1)]

} else {

maby <- 2 * (0.1 + max(abs(y)))

trypnts <- seq(from=-maby,to=maby,length.out=31)

ys <- sapply(trypnts,f)

dsy <- diff(sign(ys))

if (any(dsy < 0)) {

widx <- which(dsy < 0)

intvl <- trypnts[widx + c(0,1)]

}

}

uniroot(f=f,interval=intvl,extendInt='yes')$root

}

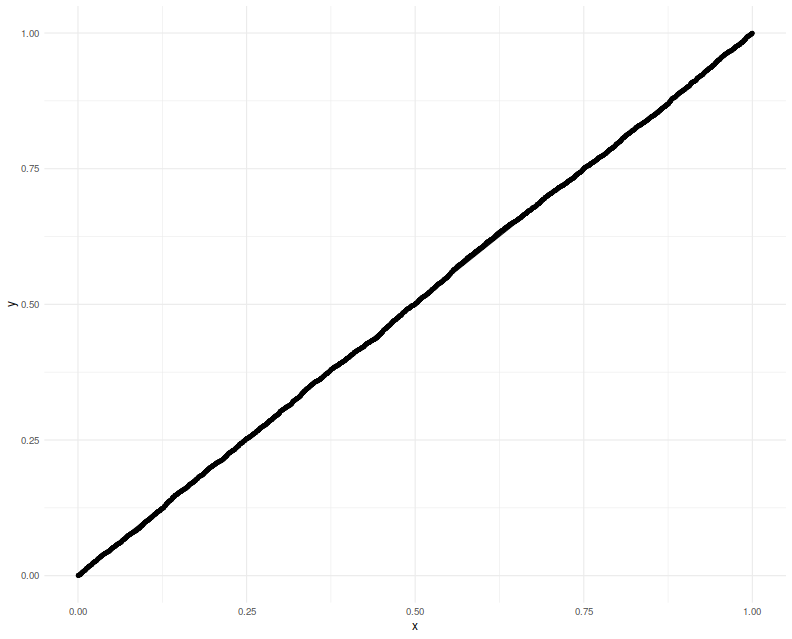

Testing on normal data

Here we test the code above on the problem considered in Theorem 5.2 of

Lee et al.

That is, we draw

$y \sim \mathcal{N}\left(\mu,\Sigma\right)$,

then observe the value of $F$ given in Theorem 5.2

when we plug in the actual population values of $\mu$ and $\Sigma$.

This is several steps removed from our problem of inference on

the SNR, but it is best to pause and make sure the implementation

is correct first.

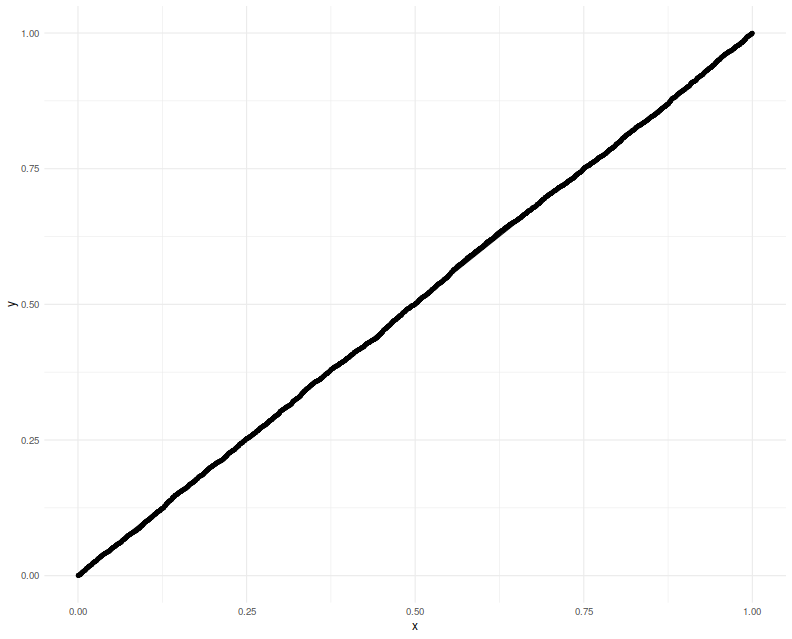

We perform 5000 simulations, letting $p=20$, then creating a random $\mu$ and

$\Sigma$, drawing a single $y$, observing which element is the maximum,

creating $A, b, \nu$, then computing the $F$ function, resulting in

a $p$-value which should be uniform. We Q-Q plot those empirical $p$-values

against a uniform law, finding them on the $y=x$ line.

gram <- function(x) { t(x) %*% x }

rWish <- function(n,p=n,Sigma=diag(p)) {

require(mvtnorm)

gram(rmvnorm(p,sigma=Sigma))

}

nsim <- 5000

p <- 20

A1 <- cbind(-1,diag(p-1))

set.seed(1234)

pvals <- replicate(nsim,{

mu <- rnorm(p)

Sigma <- rWish(n=2*p+5,p=p)

y <- t(rmvnorm(1,mean=mu,sigma=Sigma) )

# collect the maximum, so reorder the A above

yord <- order(y,decreasing=TRUE)

revo <- seq_len(p)

revo[yord] <- revo

A <- A1[,revo]

nu <- rep(0,p)

nu[yord[1]] <- 1

b <- rep(0,p-1)

foo <- ptn(y=y,A=A,b=b,nu=nu,mu=mu,Sigma=Sigma)

})

# plot them:

library(dplyr)

library(ggplot2)

ph <- data_frame(pvals=pvals) %>%

ggplot(aes(sample=pvals)) +

geom_qq(distribution=stats::qunif) +

geom_qq_line(distribution=stats::qunif)

print(ph)

Now we attempt to use the confidence interval code. We construct

a one-sided 95% confidence interval, and check how often it is violated

by the $\mu$ of the element which shows the highest $y$. We will

find that the empirical rate of violations of our confidence interval

is indeed around 5%:

nsim <- 5000

p <- 20

A1 <- cbind(-1,diag(p-1))

set.seed(1234)

tgtval <- 0.95

viols <- replicate(nsim,{

mu <- rnorm(p)

Sigma <- rWish(n=2*p+5,p=p)

y <- t(rmvnorm(1,mean=mu,sigma=Sigma) )

# collect the maximum, so reorder the A above

yord <- order(y,decreasing=TRUE)

revo <- seq_len(p)

revo[yord] <- revo

A <- A1[,revo]

nu <- rep(0,p)

nu[yord[1]] <- 1

b <- rep(0,p-1)

# mu is unknown to this guy

foo <- citn(p=tgtval,y=y,A=A,b=b,nu=nu,Sigma=Sigma)

violated <- mu[yord[1]] < foo

})

print(sprintf('%.2f%%',100*mean(viols)))

Testing on the Sharpe ratio

To use this machinery to perform inference on the SNR, we can either port

the results to the multivariate $t$-distribution,

which seems unlikely because uncorrelated marginals of a multivariate

$t$ are not independent.

Instead we lean on the normal approximation to the vector of Sharpe ratios.

If the $p$-vector $x$ is normal with correlation matrix $R$, then

$$

\hat{\zeta}\approx\mathcal{N}\left(\zeta,\frac{1}{n}\left(

R + \frac{1}{2}\operatorname{Diag}\left(\zeta\right)\left(R \odot R\right)\operatorname{Diag}\left(\zeta\right)

\right)\right),

$$

where $\hat{\zeta}$ is the $p$-vector of Sharpe ratios

computed by observing $n$ independent draws of $x$, and

$\zeta$ is the $p$-vector of Signal Noise ratios.

Note how this generalizes the 'Lo' form of the standard

error of a scalar Sharpe ratio, viz

$\sqrt{(1 + \zeta^2/2)/n}$.

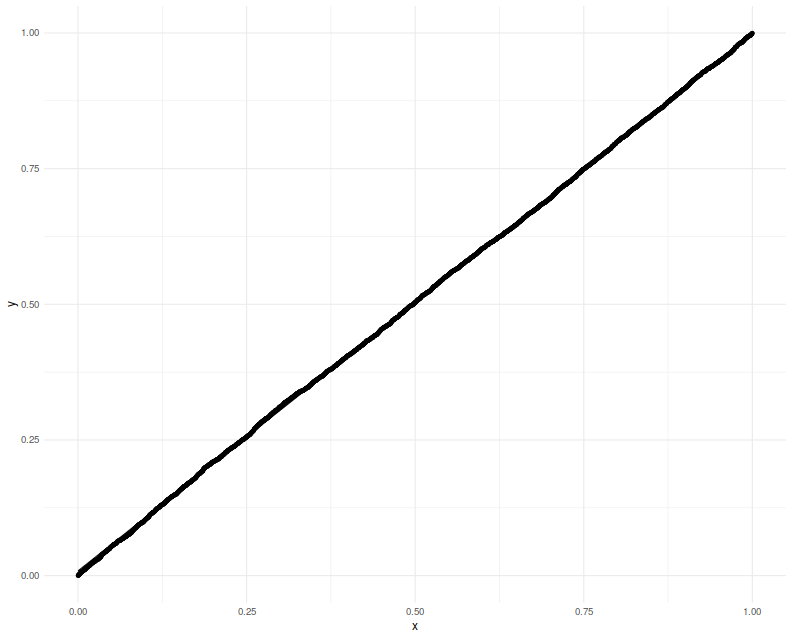

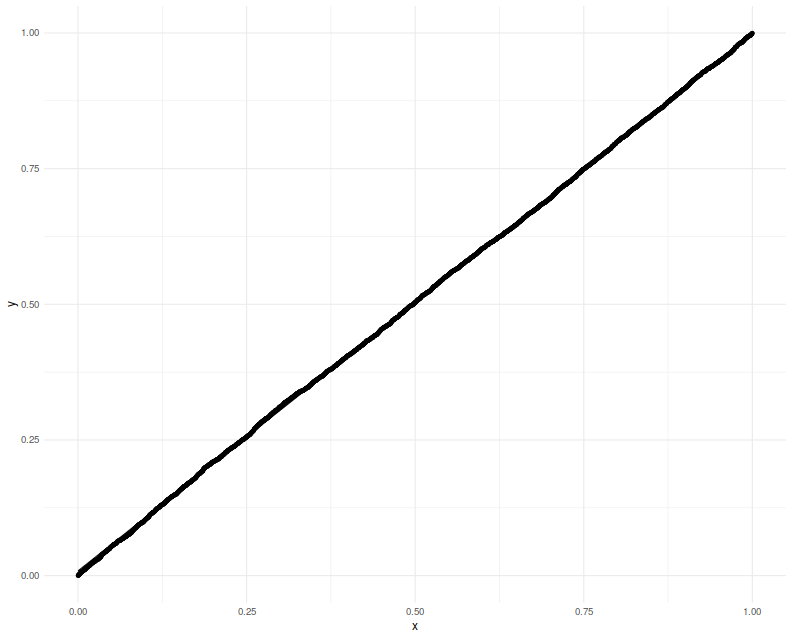

Here we will check the uniformity of $p$ values resulting from

using this normal approximation. This is closer to the actual

inference we want to do, except we will cheat by using the actual $R$ and $\zeta$

to construct what is essentially the $\Sigma$ to Lee's formulation.

We will set $p=20$ and draw 3 years of daily data.

Again we plot the putative $p$-values against uniformity

and find a good match.

# let's test it!

nsim <- 5000

p <- 20

ndays <- 3 * 252

A1 <- cbind(-1,diag(p-1))

set.seed(4321)

pvals <- replicate(nsim,{

# population values here

mu <- rnorm(p)

Sigma <- rWish(n=2*p+5,p=p)

RRR <- cov2cor(Sigma)

zeta <- mu /sqrt(diag(Sigma))

Xrets <- rmvnorm(ndays,mean=mu,sigma=Sigma)

srs <- colMeans(Xrets) / apply(Xrets,2,FUN=sd)

y <- srs

mymu <- zeta

mySigma <- (1/ndays) * (RRR + (1/2) * diag(zeta) %*% (RRR * RRR) %*% diag(zeta))

# collect the maximum, so reorder the A above

yord <- order(y,decreasing=TRUE)

revo <- seq_len(p)

revo[yord] <- revo

A <- A1[,revo]

nu <- rep(0,p)

nu[yord[1]] <- 1

b <- rep(0,p-1)

foo <- ptn(y=y,A=A,b=b,nu=nu,mu=mymu,Sigma=mySigma)

})

# plot them:

library(dplyr)

library(ggplot2)

ph <- data_frame(pvals=pvals) %>%

ggplot(aes(sample=pvals)) +

geom_qq(distribution=stats::qunif) +

geom_qq_line(distribution=stats::qunif)

print(ph)

Lastly we make one more modification, filling in

sample estimates for $\zeta$ and $R$ into the computation

of the covariance.

We compute

one-sided 95% confidence intervals, and check how the empirical

rate of violations.

We find the rate to be around 5%.

nsim <- 5000

p <- 20

ndays <- 3 * 252

A1 <- cbind(-1,diag(p-1))

set.seed(9873) # 5678 gives exactly 250 / 5000, which is eerie

tgtval <- 0.95

viols <- replicate(nsim,{

# population values here

mu <- rnorm(p)

Sigma <- rWish(n=2*p+5,p=p)

RRR <- cov2cor(Sigma)

zeta <- mu /sqrt(diag(Sigma))

Xrets <- rmvnorm(ndays,mean=mu,sigma=Sigma)

srs <- colMeans(Xrets) / apply(Xrets,2,FUN=sd)

Sighat <- cov(Xrets)

Rhat <- cov2cor(Sighat)

y <- srs

# now use the sample approximations.

# you can compute this from the observed information.

mySigma <- (1/ndays) * (Rhat + (1/2) * diag(srs) %*% (Rhat * Rhat) %*% diag(srs))

# collect the maximum, so reorder the A above

yord <- order(y,decreasing=TRUE)

revo <- seq_len(p)

revo[yord] <- revo

A <- A1[,revo]

nu <- rep(0,p)

nu[yord[1]] <- 1

b <- rep(0,p-1)

# mu is unknown to this guy

foo <- citn(p=tgtval,y=y,A=A,b=b,nu=nu,Sigma=mySigma)

violated <- zeta[yord[1]] < foo

})

print(sprintf('%.2f%%',100*mean(viols)))

Putting it together

Lee's method appears to give nominal coverage for hypothesis tests and confidence

intervals on the SNR of the asset with maximal Sharpe.

In principle it should not be affected by correlation of the assets

or by large differences in the SNRs of the assets.

It should be applicable in the $p > n$ case, as we are not inverting

the covariance matrix.

On the negative side, requiring one estimate the correlation of assets

for the computation will not scale with large $p$.

We are guardedly optimistic that this method is not adversely affected by the

normal approximation of the Sharpe ratio,

although it would be ill-advised to use it for the case of small samples

until more study is performed.

Moreover the quantile function we hacked together here should be improved

for stability and accuracy.

Click to read and post comments

In a previous blog post we looked at a statistical test

for overfitting of trading strategies proposed by Lopez de Prado,

which essentially uses a $t$-test threshold on the maximal Sharpe of backtested

returns based on assumed independence of the returns. (Actually

it is not clear if Lopez de Prado suggests a $t$-test or relies on

approximate normality of the $t$, but they are close enough.)

In that blog post, we found that in the presence of mutual positive correlation

of the strategies, the test would be somewhat conservative. It is hard

to say just how conservative the test would be without making some assumptions

about the situations in which it would be used.

This is a trivial point, but needs to be mentioned: to create a useful test of

strategy overfitting, one should consider how strategies are developed and

overfit. There are numerous ways that trading strategies are, or

could be developed. I will enumerate some here, roughly in order of

decreasing methodological purity:

-

Alice the Quant goes into the desert on a Vision Quest. She emerges three days later

with a fully formed trading idea, and backtests it a single time to

satisfy the investment committee. The strategy is traded unconditional

on the results of that backtest.

-

Bob the Quant develops a black box that generates, on demand, a quantitative trading

strategy, and performs a backtest on that strategy to produce an unbiased

estimate of the historical performance of the strategy. All strategies

are produced de novo, without any relation to any other strategy

ever developed, and all have independent returns. The black box can

be queried ad infinitum. (This is essentially Lopez de Prado's

assumed mode of development.)

-

The same as above, but the strategies possibly have correlated returns, or

were possibly seeded by published anomalies or trading ideas.

-

Carole the Quant produces a single new trading idea, in a white box, that is parametrized by

a number of free parameters. The strategy is backtested on many settings

of those parameters, which are chosen by some kind of design, and the

settings which produce the maximal Sharpe are selected.

-

The same as above, except the parameters are optimized based on backtested

Sharpe using some kind of hill-climbing heuristic or an optimizer.

-

The same as above, except the trading strategy was generally known and

possibly overfit by other parties prior to publication as "an anomaly".

-

Doug the Quant develops a gray box trading idea, adding and removing parameters while

backtesting the strategy and debugging the code, mixing machine and human

heuristics, and leaving no record of the entire process.

-

A small group of Quants separately develop a bunch of trading strategies,

using common data and tools, but otherwise independently hillclimb the

in-sample Sharpe, adding and removing parameters, each backtesting countless

unknown numbers of times, all in competition to have money allocated to

their strategies.

-

The same, except the fund needs to have a 'good quarter', otherwise

investors will pull their money, and they really mean it this time.

The first development mode is intentionally ludicrous. (In fact, these modes are

also roughly ordered by increasing realism.) It is the only development model

that might result in underfitting.

The division between the second and third modes is loosely quantifiable by

the mutual correlation among strategies, as considered in the previous blog post.

But it is not at all clear how to approach the remaining development modes with the

maximal Sharpe statistic.

Perhaps a "number of pseudo-independent backtests" could be estimated and

then used with the proposed test, but one cannot say how this would

work with in-sample optimization, or the diversification benefit of looking

in multidimensional parameter space.

The Markowitz Approximation

Perhaps the maximal Sharpe test can be salvaged, but

I come to bury Caesar, not to resuscitate him.

Some years ago, I developed a test for overfitting based on an approximate

portfolio problem. I am ashamed to say, however, that while writing this

blog post I have discovered that this approximation is not as accurate as I had

remembered! It is interesting enough to present, I think, warts and all.

Suppose you could observe the time series of

backtested returns from all the backtests considered. By 'all', I want to be

very inclusive if the parameters were somehow optimized by some closed form

equation, say. Let $Y$ be the $n \times k$ matrix of returns, with each row

a date, and each column one of the backtests. We suppose we have selected

the strategy which maximizes Sharpe, which corresponds to picking the column of

$Y$ with the largest Sharpe.

Now perform some kind of dimensionality reduction on the matrix $Y$ to arrive

at

$$

Y \approx X W,

$$

where $X$ is an $n \times l$ matrix, and $W$ is an $l \times k$ matrix, and

where $l \ll k$.

The columns of $X$ approximately span the columns of $Y$. Picking the strategy

with maximal Sharpe now approximately corresponds to picking a column of $W$

that has the highest Sharpe when multiplied by $X$. That is, our original

overfitting approximately corresponded to the optimization problem

$$

\max_{w \in W} \operatorname{Sharpe}\left(X w\right).

$$

The unconstrained version of this optimization problem is solved by the

Markowitz portfolio. Moreover, if the returns $X$ are multivariate normal

with independent rows, then the distribution of the (squared) Sharpe of

the Markowitz portfolio is known, both under the null hypothesis (columns of

$X$ are all zero mean), and the alternative (the maximal achievable population

Sharpe is non-zero), via Hotelling's $T^2$ statistic.

If $\hat{\zeta}$ is the (in-sample) Sharpe of the (in-sample) Markowitz

portfolio on $X$, assumed i.i.d. Normal, then

$$

\frac{(n-l) \hat{\zeta}^2}{l (n - 1)}

$$

follows an F distribution with $l$ and $n-l$ degrees of freedom. I wrote

the psropt and qsropt functions in SharpeR to compute the CDF and

quantile of the maximal in-sample Sharpe to support this kind of analysis.

I should note there are a few problems with this approximation:

-

There is no strong theoretical basis for this approximation:

we do not have a model for how correlated returns should arise

for a particular population, nor what the dimension $l$ should be,

nor what to expect under the alternative,

when the true optimal strategy has positive Sharpe.

(I suspect that posing overfit of backtests as a Gaussian Process

might be fruitful.)

-

We have to estimate the dimensionality, $l$, which is about as

odious as estimating the number of 'pseudo-observations' in the

maximal Sharpe test. I had originally suspected that $l$ would

be 'obvious' from the application, but this is not apparently so.

-

Although the returns may live nearly in an $l$ dimensional subspace,

we might have have selected a suboptimal combination of them in

our overfitting process. This would be of no consequence if the

$l$ were accurately estimated, but it will stymie our testing

of the approximation.

Despite these problems, let us press on.

An example: a two window Moving Average Crossover

While writing this blog post, I went looking for examples of 'classical'

technical strategies which would be ripe for overfitting (and which I could

easily simulate under the null hypothesis).

I was surprised to find that freely available material on Technical Analysis

was even worse than I could imagine. Nowhere among the annotated plots with silly

drawings could I find a concrete description of a trading strategy, possibly

with free parameters to be fit to the data.

Rather than wade through that swamp any longer, I went with an old classic,

the Moving Average Crossover.

The idea is simple: compute two moving averages of the price series with

different windows. When one is greater than the other, hold the asset long,

otherwise hold it short. The choice of two windows must be overfit by the quant.

Here I perform that experiment, but under the null hypothesis, with

zero mean simulated returns generated independently of each other.

Any realization of this strategy, with any choice of the windows, will

have zero mean returns and thus zero Sharpe.

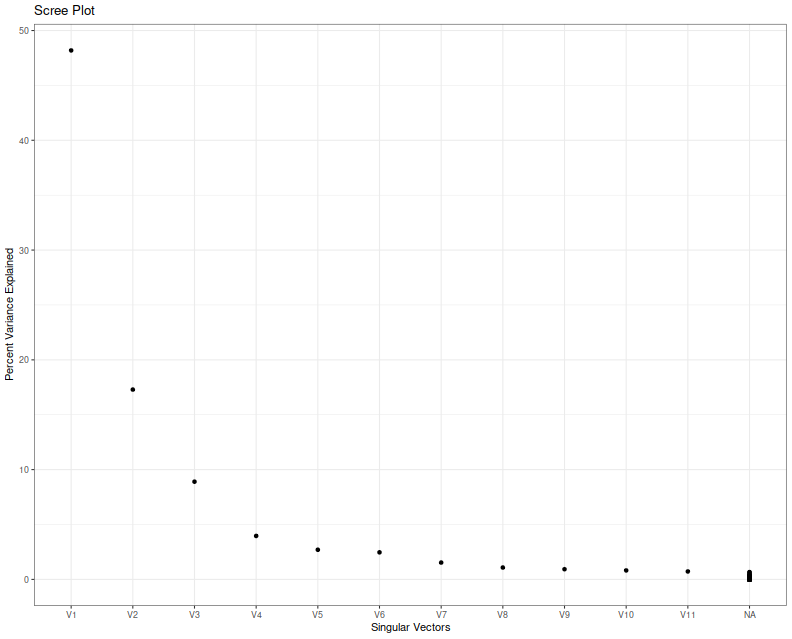

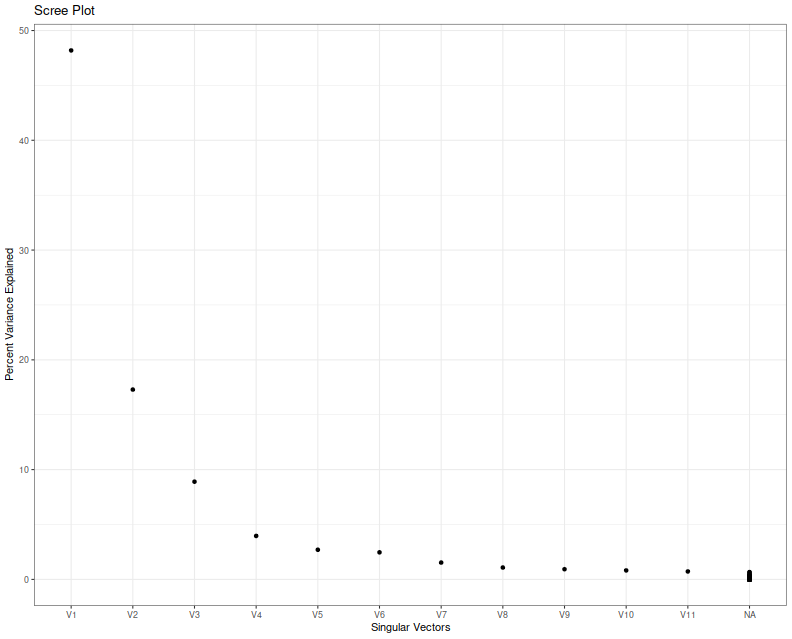

First I collect 'backtests' (sans any trading costs) of two window MAC

for a single realization of returns

where the two windows were allowed to vary from 2 to around 1000. The backtest

period is 5 years of daily data. I compute the singular value decomposition of

the returns, then present a scree plot of the singular values.

suppressMessages({

library(dplyr)

library(fromo)

library(svdvis)

library(ggplot2)

})

# return time series of *all* backtests

backtests <- function(windows,rel_rets) {

nwin <- length(windows)

nc <- choose(nwin,2)

fwd_rets <- dplyr::lead(rel_rets,1)

# log returns

log_rets <- log(1 + rel_rets)

# price series

psers <- exp(cumsum(log_rets))

avgs <- lapply(windows,fromo::running_mean,v=psers)

X <- matrix(0,nrow=length(rel_rets),ncol=2*nc)

idx <- 1

for (iii in 1:(nwin-1)) {

for (jjj in (iii+1):nwin) {

position <- sign(avgs[[iii]] - avgs[[jjj]])

myrets <- position * fwd_rets

X[,idx] <- myrets

X[,idx+1] <- -myrets

idx <- idx + 1

}

}

# trim the last row, which has the last NA

X <- X[-nrow(X),]

X

}

geomseq <- function(from=1,to=1,by=(to/from)^(1/(length.out-1)),length.out=NULL) {

if (missing(length.out)) {

lseq <- seq(log(from),log(to),by=log(by))

} else {

lseq <- seq(log(from),log(to),by=log(by),length.out=length.out)

}

exp(lseq)

}

# which windows to test

windows <- unique(ceiling(geomseq(2,1000,by=1.15)))

nobs <- ceiling(3 * 252)

maxwin <- max(windows)

rel_rets <- rnorm(maxwin + 10 + nobs,mean=0,sd=0.01)

XX <- backtests(windows,rel_rets)

# grab the last nobs rows

XX <- XX[(nrow(XX)-nobs+1):(nrow(XX)),]

# perform svd

blah <- svd(x=XX,nu=11,nv=11)

# look at it

ph <- svdvis::svd.scree(blah) +

labs(x='Singular Vectors',y='Percent Variance Explained')

print(ph)

I think we can agree that nobody knows how to interpret a scree plot.

However, in this case a large proportion of the explained variance

seems to encoded in the first two eigenvalues, which is consistent

with my a priori guess that $l=2$ in this case because of the

two free parameters.

Next I simulate overfitting, performing that same experiment, but

picking the largest in-sample Sharpe ratio.

I create a series of independent zero mean

returns, then backtest a bunch of MAC strategies, and save the maximal Sharpe

over a 3 year window of daily data.

I repeat this experiment ten thousand times,

and then look at the distribution of that maximal Sharpe.

suppressMessages({

library(dplyr)

library(tidyr)

library(tibble)

library(SharpeR)

library(future.apply)

library(ggplot2)

})

ope <- 252

geomseq <- function(from=1,to=1,by=(to/from)^(1/(length.out-1)),length.out=NULL) {

if (missing(length.out)) {

lseq <- seq(log(from),log(to),by=log(by))

} else {

lseq <- seq(log(from),log(to),by=log(by),length.out=length.out)

}

exp(lseq)

}

# one simulation. returns maximal Sharpe

onesim <- function(windows,n=1000) {

maxwin <- max(windows)

rel_rets <- rnorm(maxwin + 10 + n,mean=0,sd=0.01)

fwd_rets <- dplyr::lead(rel_rets,1)

# log returns

log_rets <- log(1 + rel_rets)

# price series

psers <- exp(cumsum(log_rets))

avgs <- lapply(windows,fromo::running_mean,v=psers)

nwin <- length(windows)

maxsr <- 0

for (iii in 1:(nwin-1)) {

for (jjj in (iii+1):nwin) {

position <- sign(avgs[[iii]] - avgs[[jjj]])

myrets <- position * fwd_rets

# compute Sharpe on some part of this

compon <- myrets[(length(myrets)-n):(length(myrets)-1)]

thissr <- SharpeR::as.sr(compon,ope=ope)$sr

# we are implicitly testing both combinations of long and short here,

# so we take the absolute Sharpe, since we will always overfit to

# the better of the two:

maxsr <- max(maxsr,abs(thissr))

}

}

maxsr

}

windows <- unique(ceiling(geomseq(2,1000,by=1.15)))

nobs <- ceiling(3 * 252)

nrep <- 10000

plan(multicore)

set.seed(1234)

system.time({

simvals <- future_replicate(nrep,onesim(windows,n=nobs))

})

user system elapsed

1227.959 4.398 307.299

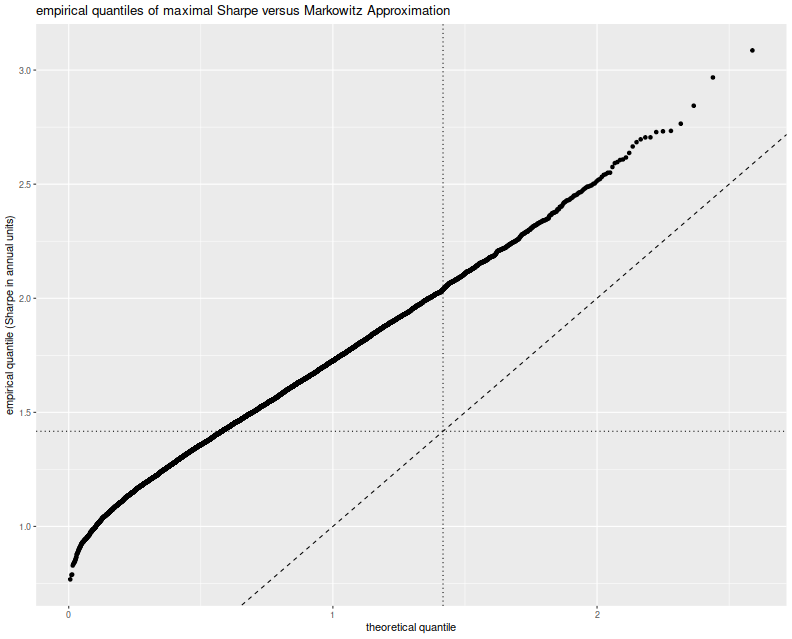

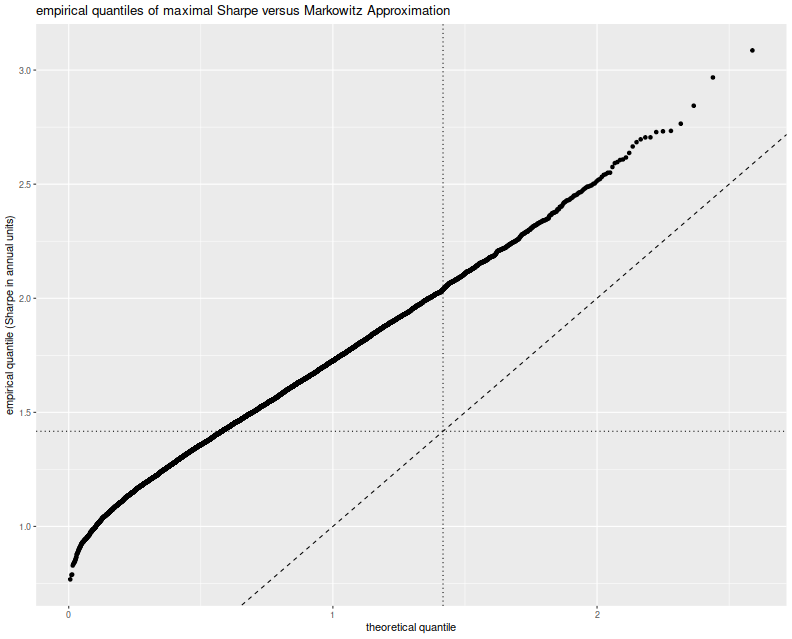

Here I plot the empirical quantiles of the maximal (annualized) Sharpe versus

theoretical quantiles under the Markowitz approximation, assuming $l=2$.

I also plot the $y=x$ lines, and horizontal and vertical lines at the nominal

upper $0.05$ cutoff based on the Markowitz approximation.

# plot max value vs quantile:

library(ggplot2)

apxdf <- 2.0

ph <- data.frame(simvals=simvals) %>%

ggplot(aes(sample=simvals)) +

geom_vline(xintercept=SharpeR::qsropt(0.95,df1=apxdf,df2=nobs,zeta.s=0,ope=ope),linetype=3) +

geom_hline(yintercept=SharpeR::qsropt(0.95,df1=apxdf,df2=nobs,zeta.s=0,ope=ope),linetype=3) +

stat_qq(distribution=SharpeR::qsropt,dparams=list(df1=apxdf,df2=nobs,zeta.s=0,ope=ope)) +

geom_abline(intercept=0,slope=1,linetype=2) +

labs(title='empirical quantiles of maximal Sharpe versus Markowitz Approximation',

x='theoretical quantile',y='empirical quantile (Sharpe in annual units)')

print(ph)

This approximation is clearly no good. The empirical rate of type I errors

at the $0.05$ level is around 60%,

and the Q-Q line is just off. I must admit that when I previously looked at

this approximation (and in the vignette for SharpeR!) I used the qqline

function in base R, which fits a line based on the first and third quartile

of the empirical fit. That corresponds to an affine shift of the line we see

here, and nothing seems amiss.

So perhaps the Markowitz approximation can be salvaged, if I can figure out why

this shift occurs. Perhaps we have only traded picking a maximal $t$ for

picking a maximal $T^2$ and there still has to be a mechanism to account for

that. Or perhaps in this case, despite the 'obvious' setting of $l=2$, we

should have chosen $l=7$, for which the empirical rate of

type I errors is around 60%, though

we have no way of seeing that 7 from the scree plot or by looking at

the mechanism for generating strategies. Or perhaps the problem is that we

have not actually picked a maximal strategy over the subspace, and this

technique can only be used to provide a possibly conservative test. In this

regard, our test would be no more useful than the maximal Sharpe test

described in the previous blog post.

Click to read and post comments